Prospecting tools for financial advisors streamline client acquisition and relationship management. They optimize lead generation and enhance client engagement strategies.

In the competitive field of financial advising, a strong client base serves as the backbone of a successful practice. To secure and maintain this essential asset, financial advisors need to employ a range of prospecting tools that are not only effective but also efficient and user-friendly.

The right tools can significantly improve the chances of reaching potential clients, understanding their needs, and converting them into loyal customers. From Customer Relationship Management (CRM) systems that organize contacts and interactions to data analytics platforms that predict future market trends, these prospecting resources are crucial for advisors aiming to grow their business in a sustainable manner. Engaging content via personalized email campaigns, social media presence, and educational workshops are also key strategies supported by digital tools, which help build trust and authority in the financial field.

2. Traditional Prospecting Methods

Traditional Prospecting Methods remain cornerstone techniques for financial advisors eager to expand their client base. While digital strategies soar in popularity, these conventional approaches still offer direct, personalized touch points with potential clients. Let’s dive into the tried-and-true methods that continue to fuel successful prospecting endeavors in the finance sector.

2.1 Cold Calling

The art of cold calling involves reaching out to potential clients via phone. Though seen by some as outdated, its effectiveness lies in the personal connection established between the caller and the prospect. Successful cold calling requires preparation, a clear message, and persistence.

- Prepare a concise script with key points.

- Understand the prospect’s potential needs.

- Keep calls short and engaging.

2.2 Direct Mail Campaigns

Direct mail campaigns send physical marketing materials to prospects’ mailboxes. This method benefits from tangible items that recipients can touch, feel, and keep. Tailoring content to the recipient’s interests can significantly increase the campaign’s impact.

| Element | Impact |

|---|---|

| Personalized Letter | Builds a connection with the recipient |

| Informative Brochure | Highlights services and expertise |

| Business Card | Provides easy contact information |

2.3 Seminars And Workshops

Hosting seminars and workshops is an effective way to demonstrate expertise and engage with a group of potential clients. This setting allows for real-time interaction, questions, and the establishment of credibility. Topics covered should resonate with attendees and offer actionable insights.

- Choose relevant financial topics.

- Engage the audience with interactive content.

- Provide useful handouts and resources.

Credit: www.modelfa.com

3. Digital Prospecting Tools

In the modern age, financial advisors rely heavily on digital tools for client acquisition. These tools streamline the prospecting process. They open doors to a wealth of potential clients. Let’s delve into digital prospecting resources that bring high returns for smart, forward-thinking financial advisors.

3.1 Social Media Marketing

Social media platforms are indispensable for financial advisors. They offer unique ways to engage with prospective clients. Use these platforms to showcase expertise:

- LinkedIn – Connect with professionals seeking financial advice.

- Facebook – Share informative content to attract a broad audience.

- Twitter – Engage in financial conversations and provide quick tips.

The right strategy leads to a robust online presence. It can significantly increase prospecting success rates.

3.2 Content Marketing

Quality content attracts and educates potential clients. Consider these methods:

| Content Type | Benefits |

|---|---|

| Blogs | Drive traffic to your site with SEO-optimized posts. |

| E-books | Offer in-depth guidance in exchange for email contacts. |

| Videos | Visual content increases engagement and understanding. |

Effective content marketing establishes trust. It positions you as an industry thought leader.

3.3 Email Marketing

Email campaigns remain a powerful tool. They nurture leads through personalized communication. Here’s how:

- Create compelling subject lines to boost open rates.

- Offer valuable insights and solutions in your emails.

- Use a clear call-to-action to guide readers towards the next step.

A sound email marketing strategy keeps you top-of-mind with prospects.

4. Customer Relationship Management (crm) Systems

Modern financial advisors face a competitive landscape that requires sophisticated tools. Among these, CRM systems stand out as essential for maintaining and expanding client relationships. By centralizing client information and automating key tasks, CRM platforms can significantly enhance prospecting efforts.

4.1 Benefits Of Crm For Prospecting

- Streamlined Data Management: Organize client data effectively for easier access and follow-up.

- Improved Client Interactions: Customize communication based on client needs and history.

- Efficiency: Automate tasks to focus more on client engagement and acquisition.

- Performance Tracking: Analyze and refine prospecting strategies with detailed reports.

4.2 Features To Consider In A Crm System

Selecting the right CRM system involves understanding the features that cater to the specific needs of financial advisors:

| Feature | Description |

|---|---|

| Lead Management | Tracks prospects through the sales pipeline. |

| Integration | Connects with other tools such as email and financial planning software. |

| Customization | Tailors to the unique processes of a financial advisor’s practice. |

| Security | Protects sensitive client data with robust security measures. |

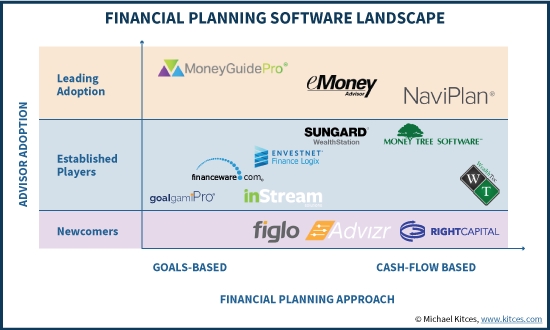

4.3 Popular Crm Systems For Financial Advisors

Here are some popular CRM systems known for empowering financial advisors in prospecting:

- Salesforce: Offers extensive customization and a rich ecosystem of integrations.

- Redtail Technology: Tailored for the financial services industry with strong client service features.

- Wealthbox: A user-friendly interface coupled with collaborative tools for team-based practices.

Credit: www.kitces.com

5. Prospecting Tools For Data Analysis And Research

5. Prospecting Tools for Data Analysis and Research

Financial advisors need powerful tools for data analysis and research. These tools help in understanding market trends and client requirements better. They also aid financial advisors to provide valuable insights to their clients.

5.1 Financial Research Platforms

Financial research platforms form the backbone of investment strategies. They offer real-time market data, financial news, and expert analysis. These platforms provide a competitive edge through comprehensive information.

- Morningstar: Offers in-depth research and rankings on investments.

- Bloomberg Terminal: Provides financial software tools for analysis.

- Yahoo Finance: Supplies financial news, data, and commentary.

5.2 Data Analytics Tools

Data analytics tools enable advisors to decipher vast amounts of data. They interpret patterns and predict market behavior. Such insights help craft tailored advice for clients.

- Tableau: Transforms data into actionable insights with ease.

- Microsoft Power BI: Helps visualize data for better decision-making.

- Google Analytics: Tracks and reports website traffic for client engagement.

5.3 Customer Profiling Software

Customer profiling software segments clients based on their financial behavior. It helps in identifying the most valuable customers and understanding their needs.

| Software | Function |

|---|---|

| CRM systems | Manages client data for personalized service. |

| HubSpot | Tracks client interactions and identifies opportunities. |

| Salesforce | Offers customer insights and improves client relationships. |

Credit: www.skylinesocial.com

Frequently Asked Questions On Prospecting Tools For Financial Advisors

What Are Top Prospecting Tools For Advisors?

Prospecting tools help financial advisors find and engage potential clients. Popular ones include LinkedIn Sales Navigator for networking, WealthEngine for wealth intelligence, and Hootsuite for managing social media outreach efficiently.

How Do Crm Systems Aid In Prospecting?

CRM systems streamline client management and prospect interactions for financial advisors. They provide centralized data storage, ensuring efficient follow-up, personalized communication, and improved lead management, boosting the chances of converting prospects into clients.

Can Advisors Automate Prospecting Activities?

Yes, financial advisors can automate prospecting using tools like Marketo or HubSpot. These platforms automate email campaigns, follow-ups, and lead scoring, helping advisors nurture leads without manual effort, saving time, and increasing productivity.

What Role Does Data Analysis Play In Prospecting?

Data analysis is vital in prospecting, as it helps financial advisors identify the most promising leads based on historical data and predictive modeling. Tools with analytics capabilities allow for targeted approaches, increasing the likelihood of successful engagements.

Conclusion

Effective prospecting is crucial for any financial advisor seeking growth. By leveraging innovative tools, advisors can streamline their outreach and foster stronger client relationships. Remember, the right mix of technology and personal touch can set you apart in a competitive market.

Embrace these tools to enhance your financial advising journey and ensure sustained success.