Lead generation in life insurance is the process of attracting potential customers and gathering their contact information for future sales opportunities. With effective lead generation strategies, insurance companies can reach out to a targeted audience, increasing their chances of converting leads into insurance policyholders.

In today’s competitive market, life insurance companies need a robust lead generation strategy to stay ahead. This involves utilizing various digital channels and strategies to reach a wider audience, such as search engine optimization (SEO), social media marketing, content marketing, and paid advertising.

By leveraging these channels effectively, insurance companies can generate quality leads and nurture them throughout the customer journey. We will explore the importance of lead generation in the life insurance industry and discuss effective strategies to help companies attract and convert leads into loyal policyholders. So, let’s dive in and discover how you can maximize lead generation for your life insurance business.

Credit: www.linkedin.com

What Is Lead Generation?

Lead generation in life insurance refers to the process of identifying and attracting potential customers interested in purchasing life insurance policies. It involves strategies such as targeted marketing campaigns, online forms, and networking to capture and cultivate potential leads. This method aims to connect insurance providers with individuals seeking life coverage, ultimately boosting sales and clientele.

What is Lead Generation? Lead generation in the context of life insurance refers to the process of identifying and attracting potential customers who may be interested in purchasing life insurance products or services. This is typically achieved through various marketing and promotional strategies aimed at capturing the attention of individuals who are likely to have a need for life insurance.

Definition Of Lead Generation

Lead generation involves the identification and cultivation of prospective customers who have expressed interest in a particular product or service. In the context of life insurance, lead generation aims to gather contact information and generate potential leads who may be interested in purchasing life insurance policies.

Importance Of Lead Generation

Lead generation is vital for life insurance companies as it enables them to connect with individuals who are in need of financial protection for themselves and their families. By generating leads, insurance providers can expand their customer base and increase sales, ultimately contributing to the growth and success of their business. In order to effectively generate and manage leads, life insurance companies often utilize targeted marketing campaigns, strategic partnerships, and online lead generation tools. By focusing on the importance of lead generation, insurers can ensure that they are reaching and engaging with potential customers who are seeking the security and benefits that life insurance can provide.

Credit: www.amazon.com

Why Is Lead Generation Important For Life Insurance?

Lead generation is a crucial aspect of the life insurance industry. It plays a vital role in building a customer base, increasing sales, and driving growth. Implementing effective lead generation strategies can help life insurance companies thrive in a competitive marketplace. In this section, we will explore the importance of lead generation in the life insurance sector and how it contributes to different aspects of business success.

Building A Customer Base

Building a robust customer base is the foundation of a successful life insurance business. Effective lead generation enables companies to reach potential customers who are likely to be interested in purchasing life insurance policies. By targeting specific demographic groups and conducting extensive market research, insurance providers can identify individuals who are most likely to become customers.

Once these leads are generated, companies can engage with them through various marketing channels, such as email campaigns, social media platforms, and online advertisements. These tactics create brand awareness and help nurture leads into loyal customers. Besides, maintaining a strong customer base through effective lead generation enables companies to establish long-lasting relationships, drive customer loyalty, and increase customer referrals.

Increasing Sales

The core objective of lead generation in the life insurance industry is to generate quality leads that can be converted into policy sales. Acquiring leads that have shown an interest in life insurance can significantly increase the chances of closing deals. By using effective lead generation strategies, life insurance companies can target potential customers who are actively seeking coverage.

Once a lead expresses interest, timely follow-ups and personalized communication can be leveraged to build trust and address any concerns they might have. By nurturing leads through the sales funnel, companies can increase their chances of converting them into paying customers. Implementing effective lead generation tactics ensures a consistent stream of potential customers, leading to increased sales and revenue for life insurance providers.

Driving Growth

Lead generation is instrumental in driving growth for life insurance companies. By consistently generating quality leads, businesses can expand their customer base and market presence. The ability to identify and target potential customers effectively ensures a steady flow of qualified leads and enables companies to stay ahead of the competition.

Furthermore, lead generation allows life insurance providers to adapt their marketing strategies based on the insights gained from analyzing lead data. This data can help optimize campaigns, tailor messaging, and identify new opportunities for growth. By leveraging the power of effective lead generation, life insurance companies can position themselves for sustainable growth and success in the industry.

Strategies For Effective Lead Generation In Life Insurance

Effective lead generation is crucial for success in the highly competitive world of life insurance. To thrive in this industry, insurance agents must employ strategic approaches to attract and convert potential clients. In this blog post, we will explore four key strategies that can help insurance professionals generate high-quality leads and boost their business. By targeting the right audience, utilizing online marketing, leveraging social media, and creating engaging content, agents can position themselves for success in the life insurance market.

Targeting The Right Audience

When it comes to lead generation in life insurance, targeting the right audience is essential. By identifying potential customers who are actively seeking or in need of life insurance, agents can tailor their marketing efforts to reach the most relevant prospects. To ensure that you are connecting with the right audience, consider the following:

- Research your target market: Gain a deep understanding of your ideal customers. Identify their demographics, interests, and needs to create precise customer profiles.

- Develop a buyer persona: Use the information gathered from research to create a detailed buyer persona. This will serve as a reference point for all your marketing efforts.

- Segment your audience: Divide your target audience into distinct segments based on relevant factors such as age, income, occupation, or life stage. This will enable you to customize your message and approach for each segment.

Utilizing Online Marketing

In today’s digital age, online marketing has become an indispensable tool for lead generation in the insurance industry. To maximize your online presence and attract potential leads, consider the following strategies:

- Search Engine Optimization (SEO): Optimize your website content to rank higher in search engine results. This will improve your visibility and attract organic traffic from people actively searching for life insurance.

- Pay-Per-Click (PPC) Advertising: Run targeted PPC campaigns on search engines and social media platforms. This allows you to display ads to users who are already interested in life insurance, increasing the chances of generating qualified leads.

- Content Marketing: Create informative and valuable content such as blog posts, ebooks, and videos that address common questions and concerns of your target audience. This establishes your authority and builds trust, making prospective clients more likely to engage with you.

Leveraging Social Media

Social media platforms offer immense opportunities for insurance professionals to connect with potential clients and generate leads. To leverage social media effectively, consider the following strategies:

- Choose the right platforms: Identify the social media platforms where your target audience is most active and create a strong presence there.

- Engage and interact: Regularly engage with your audience by sharing informative content, responding to comments and messages, and actively participating in industry-related discussions.

- Run targeted ads: Use social media advertising options to reach a highly specific audience based on demographics, interests, and behaviors. This will help you maximize the impact of your lead generation campaigns.

Creating Engaging Content

Engaging content is key to capturing the attention and interest of your target audience. To create content that resonates with potential leads, consider the following tips:

- Identify pain points: Understand the challenges and concerns your target audience may have regarding life insurance. Address these pain points in your content to provide valuable solutions and build trust.

- Use visuals: Incorporate relevant images, infographics, and videos to make your content visually appealing and easier to understand.

- Include compelling CTAs: End each piece of content with a clear and compelling call-to-action (CTA) that encourages readers to take the next step, such as contacting you for a consultation or requesting a quote.

Tools And Techniques For Lead Generation In Life Insurance

The success of a life insurance business heavily relies on effectively generating leads. However, in today’s digital age, traditional methods of lead generation no longer suffice. To stay competitive, insurance companies must embrace the tools and techniques available to them. In this article, we will explore the various tools and techniques for lead generation in life insurance, including Customer Relationship Management (CRM) Systems, Email Marketing, Search Engine Optimization (SEO), and Paid Advertising.

Customer Relationship Management (crm) Systems

A Customer Relationship Management (CRM) system is an essential tool for managing and nurturing leads in the life insurance industry. It allows insurance agents to organize and track client interactions, ensuring personalized and timely follow-ups.

- CRM systems simplify lead management by centralizing data and providing a holistic view of the sales pipeline.

- Agents can segment leads based on various parameters, such as demographics, interests, and insurance needs, enabling targeted and relevant communication.

- CRM systems also automate repetitive tasks, such as sending follow-up emails, thereby saving time and increasing productivity.

Email Marketing

Email marketing is a cost-effective and impactful way to generate and nurture leads in the life insurance sector.

- Insurance companies can capture leads through website opt-in forms, offering valuable resources or incentives in exchange for contact information.

- Once leads are captured, targeted email campaigns can be created to educate and engage the prospects.

- Personalization is key in email marketing – addressing recipients by name and tailoring the content to their specific needs increases the chances of conversion.

- Regularly sending informative newsletters and updates helps to keep your insurance services top-of-mind for potential customers.

Search Engine Optimization (seo)

Utilizing search engine optimization (SEO) techniques can significantly enhance the visibility and discoverability of your life insurance business online.

- Perform keyword research to identify relevant and high-intent keywords related to life insurance. Incorporate these keywords naturally into your website content.

- Optimize your website’s on-page elements, such as title tags, meta descriptions, and header tags, to improve search engine rankings.

- Create informative and engaging blog posts centered around life insurance topics to attract organic traffic. Share these articles on social media platforms to broaden your reach.

- Build high-quality backlinks from reputable websites to improve your website’s authority and boost search engine rankings.

Paid Advertising

Paid advertising can provide immediate results in lead generation for life insurance companies. It allows you to target specific demographics and show your ads to qualified prospects.

- Invest in pay-per-click (PPC) campaigns on search engines and social media platforms to drive targeted traffic to your website.

- Create persuasive and concise ad copy that highlights the benefits of your life insurance products.

- Utilize remarketing techniques to reach potential customers who have shown interest in your website or services.

- Analyze ad performance and make data-driven optimizations to maximize your return on investment (ROI).

Measuring And Analyzing Lead Generation Success

Lead generation is vital for the success of any life insurance company. However, simply generating leads is not enough. To ensure your lead generation efforts are effective, you need to measure and analyze the results. This will help you understand the success of your lead generation strategies and make data-driven decisions to optimize your efforts. In this article, we will discuss key metrics to track, analyzing conversion rates, and optimizing lead generation strategies.

Key Metrics To Track

Measuring the right metrics is crucial to understanding the success of your lead generation campaigns. Here are some key metrics you should track:

- Conversion Rate: This is the percentage of leads that convert into customers. Tracking this metric provides insights into the effectiveness of your lead nurturing and sales process.

- Cost per Lead: Calculating the cost per lead helps you understand the efficiency of your lead generation efforts. By comparing this metric across different campaigns, you can identify which channels or strategies are providing the best return on investment.

- Lead Quality: It’s essential to assess the quality of your leads. Track metrics like lead source, lead demographics, and lead behavior to determine which leads are more likely to convert into customers.

- Customer Lifetime Value: This metric helps you estimate the revenue a customer will generate throughout their relationship with your insurance company. It assists in determining the long-term effectiveness of your lead generation efforts.

Analyzing Conversion Rates

Conversion rates are a crucial indicator of lead generation success. Analyzing conversion rates allows you to identify areas of improvement and optimize your strategies. Follow these steps to analyze conversion rates:

- Identify the funnels or stages in your lead generation and conversion process.

- Analyze the conversion rates for each funnel stage to pinpoint any significant drop-offs or bottlenecks.

- Identify potential causes for low conversion rates, such as complex lead forms, unclear value propositions, or lack of trust-building elements.

- Implement A/B testing to experiment with different strategies and improve conversion rates.

Optimizing Lead Generation Strategies

Optimizing your lead generation strategies is an ongoing process. By continuously evaluating and evolving your approach, you can maximize your lead generation success. Here are some tips to optimize your lead generation strategies:

- Regularly review and update your buyer personas based on market trends and customer feedback.

- Experiment with different lead generation channels, such as social media, content marketing, email campaigns, and partnerships.

- Implement lead scoring to prioritize leads and focus on those with higher conversion potential.

- Regularly test and refine your lead capture forms to optimize lead quality and conversion rates.

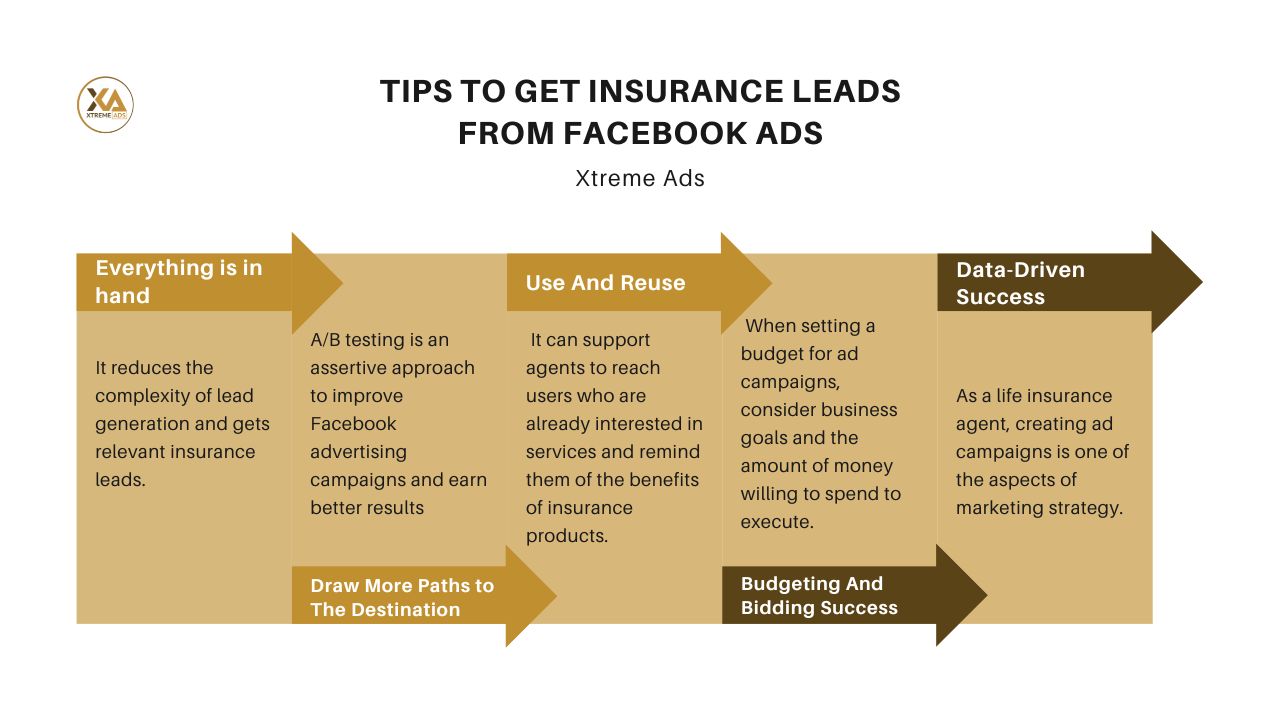

Credit: xtremeads.in

Frequently Asked Questions On Lead Generation Life Insurance

What Is Lead Generation In Life Insurance?

Lead generation in life insurance is the process of identifying and attracting potential customers who are interested in purchasing life insurance policies. It involves various marketing strategies and techniques to generate leads and convert them into clients for insurance agents and companies.

Why Is Lead Generation Important For Life Insurance Agents?

Lead generation is crucial for life insurance agents as it helps them to build a continuous stream of potential clients, resulting in increased sales and revenue. By generating quality leads, agents can focus their efforts on targeting individuals who are genuinely interested in purchasing life insurance, thus maximizing their sales potential.

What Are Some Effective Lead Generation Strategies For Life Insurance?

Effective lead generation strategies for life insurance include leveraging social media platforms, creating informative and engaging content, participating in community events, networking with other professionals, offering free quotes or consultations, and utilizing search engine optimization (SEO) techniques to improve online visibility.

These strategies can help agents attract and connect with potential clients.

How Can Agents Convert Life Insurance Leads Into Customers?

To convert life insurance leads into customers, agents should focus on building trust, providing personalized communication, offering detailed information about policy options, addressing concerns, and emphasizing the value of life insurance. By demonstrating expertise, understanding clients’ needs, and delivering exceptional customer service, agents can successfully convert leads into loyal customers.

Conclusion

Implementing an effective lead generation strategy is crucial for success in the ever-evolving life insurance industry. By leveraging targeted digital marketing tactics, engaging with potential leads on social media, and nurturing relationships through personalized communications, insurance agents can maximize their chances of converting prospects into loyal customers.

With the right strategies in place, achieving sustainable growth and profitability becomes a realistic goal for any life insurance professional. So get started today and watch your business thrive in this competitive market!