Lead generation in the insurance industry involves the process of attracting and capturing potential customers’ interest in insurance products or services. It requires targeted marketing strategies and efficient tactics to generate high-quality leads.

Generating leads is a crucial aspect of the insurance industry, as it directly impacts business growth and success. The process involves identifying and establishing contact with potential customers who are likely to be interested in insurance products or services. Effective lead generation requires implementing targeted marketing campaigns and using various channels to attract and capture the attention of potential leads.

By focusing on generating high-quality leads, insurance companies can increase their chances of converting them into paying customers, driving revenue and long-term business growth. We will explore the importance of lead generation in the insurance industry and discuss effective strategies to generate leads.

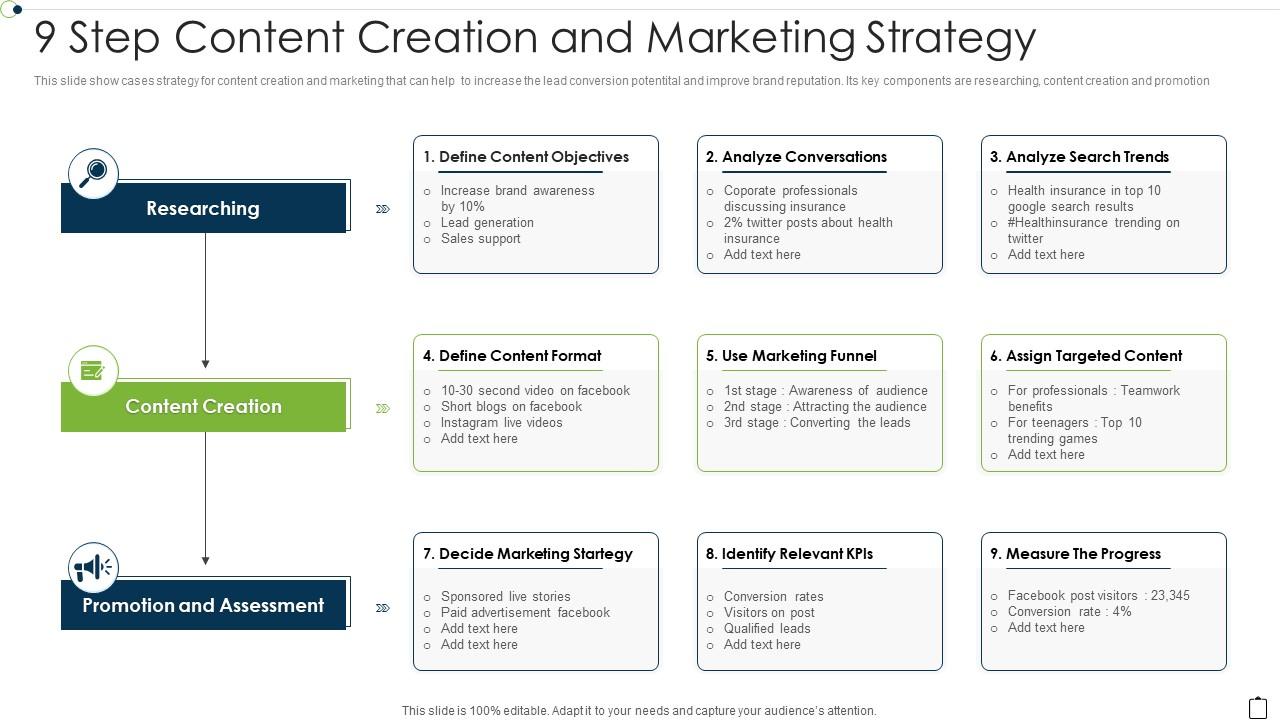

Credit: www.slideteam.net

1. Understanding Lead Generation Insurance

Lead generation is a crucial aspect of the insurance industry. It involves identifying and attracting potential customers who are interested in purchasing insurance products or services. In today’s competitive market, generating high-quality leads is more important than ever to ensure the growth and success of insurance businesses.

1.1 What Is Lead Generation?

Lead generation is the process of finding and cultivating potential customers for a specific product or service. In the insurance industry, it refers to the strategies and techniques used to attract individuals who are likely to be interested in purchasing insurance policies. These strategies may include various marketing activities such as online advertising, content marketing, social media engagement, and more.

Insurance companies rely on lead generation to connect with potential customers and build a pipeline of interested individuals. By targeting the right audience, insurance companies can maximize their chances of converting leads into actual customers, ultimately driving business growth and profitability.

1.2 The Importance Of Lead Generation In The Insurance Industry

Lead generation plays a pivotal role in the insurance industry for several reasons:

- Increased Customer Base: Effective lead generation strategies help insurance companies expand their customer base by connecting with individuals who are actively seeking insurance coverage.

- Higher Conversion Rates: By targeting individuals who are already interested in insurance products, lead generation increases the likelihood of converting leads into paying customers, resulting in higher conversion rates.

- Cost-Effective: Compared to traditional marketing methods, lead generation can be a cost-effective approach for insurance companies to acquire new customers. Instead of reaching out to a broad audience, lead generation enables companies to focus their efforts on individuals who are more likely to convert.

- Improved Marketing ROI: Lead generation allows insurance companies to track and measure the effectiveness of their marketing campaigns, enabling them to optimize their strategies and allocate resources where they yield the highest return on investment.

In today’s digital age, insurance companies need to leverage lead generation strategies to stay ahead of the competition. By understanding the importance of lead generation and implementing effective tactics, insurance companies can attract qualified leads and boost their business growth.

Credit: www.leadsquared.com

2. Strategies For Lead Generation Insurance

Lead generation is a crucial aspect of any insurance business. Without a steady stream of potential customers, it becomes challenging to grow and succeed in the industry. In this section, we will explore four strategies for lead generation insurance that can help insurance companies target the right audience, leverage digital marketing channels, create engaging content, and implement effective call-to-actions.

2.1 Targeting The Right Audience

One of the most important strategies for lead generation insurance is targeting the right audience. By identifying and understanding the demographics, needs, and interests of your target market, you can tailor your marketing efforts to reach the right people at the right time. This can be done through market research and data analysis.

2.2 Leveraging Digital Marketing Channels

In today’s digital age, leveraging digital marketing channels is essential for lead generation insurance. With the vast reach and targeting capabilities of platforms like social media, search engines, and email marketing, insurance companies can effectively promote their services to a wider audience. By adopting a multi-channel approach, you can increase visibility and generate more leads.

2.3 Creating Engaging Content

Creating engaging content is another powerful strategy for lead generation insurance. By producing high-quality blog posts, guides, videos, and infographics that provide valuable information and address the pain points of your target audience, you can attract potential customers and establish yourself as an authority in the insurance industry.

2.4 Implementing Effective Call-to-actions

Implementing effective call-to-actions (CTAs) is crucial for converting website visitors into leads. By strategically placing CTAs throughout your website and landing pages, you can guide prospects towards taking the desired action, such as filling out a form or requesting a quote. Make sure your CTAs are compelling, visually appealing, and easy to use.

By targeting the right audience, leveraging digital marketing channels, creating engaging content, and implementing effective call-to-actions, insurance companies can enhance their lead generation efforts and drive growth in their business.

3. Tools And Technologies For Lead Generation Insurance

Using the right tools and technologies is essential for effective lead generation in the insurance industry. By leveraging these tools, insurance companies can streamline their processes, improve efficiency, and enhance their overall lead generation strategies. Here are three key categories of tools and technologies that can greatly benefit insurance companies in their lead generation efforts:

3.1 Crm Software For Managing Leads

CRM (Customer Relationship Management) software plays a crucial role in managing leads and maintaining strong relationships with potential customers in the insurance sector. This software allows insurance agents to track and organize leads, store important customer data, and automate various aspects of the lead generation process.

With CRM software, insurance companies can easily capture and store lead information, such as contact details, preferences, and communication history. This centralized database enables agents to have a comprehensive view of their leads and engage with them in a more personalized and efficient manner.

| Benefits of CRM Software for Lead Generation Insurance: |

|---|

| 1. Efficient lead management and tracking |

| 2. Improved lead nurturing and customer engagement |

| 3. Streamlined communication and follow-ups |

3.2 Marketing Automation Platforms

Marketing automation platforms offer insurance companies the ability to automate various marketing and lead generation activities. These platforms allow for the creation of targeted campaigns, personalized messaging, and automated workflows based on specific lead behaviors and interactions.

By utilizing marketing automation, insurance companies can deliver relevant content and offers to their leads at the right moment, increasing the chances of conversion. These platforms also provide valuable insights and analytics to measure the effectiveness of campaigns and optimize lead generation strategies.

- Key features of marketing automation platforms for lead generation insurance:

- Email marketing automation

- Landing page creation and optimization

- Lead scoring and segmentation

3.3 Data Analytics Tools

Data analytics tools are crucial for insurance companies to gain actionable insights from their lead generation efforts. These tools help in analyzing and interpreting lead data, identifying trends and patterns, and making data-driven decisions to continuously improve lead generation strategies.

By leveraging data analytics tools, insurance companies can measure the effectiveness of their lead generation campaigns, identify the most successful acquisition channels, and optimize their marketing budgets accordingly. These tools also enable companies to understand customer behavior and preferences, leading to more targeted and impactful lead generation initiatives.

- Benefits of data analytics tools for lead generation insurance:

- Better understanding of lead behavior and preferences

- Optimized marketing campaigns and budgets

- Identification of high-performing lead sources

4. Best Practices For Successful Lead Generation Insurance

In order to generate high-quality leads for your insurance business, it is crucial to adopt the best practices that will ensure your success. Here, we will discuss four key strategies that can help you effectively generate leads for your insurance company.

4.1 Continuous Monitoring And Optimization

In the competitive insurance industry, constant monitoring and optimization of your lead generation process are essential. This involves regularly analyzing your lead generation campaigns, tracking the performance of different channels, and identifying areas for improvement.

To continuously optimize your lead generation efforts, leverage the power of data analytics. Use tracking tools and analytics software to measure the performance of your landing pages, forms, and call-to-action buttons. Identify which elements are working well and which can be further optimized to enhance conversions.

4.2 Personalizing Customer Interactions

Personalization is a key factor in successful lead generation insurance. Building personalized relationships with your prospects can substantially increase their likelihood of becoming customers. By tailoring your communications to meet the unique needs and preferences of each lead, you can establish trust and credibility.

One effective method of personalization is segmenting your leads based on their demographics, interests, or past interactions. This enables you to send targeted emails, create personalized content, and offer customized solutions that resonate with each prospect.

4.3 Balancing Automation And Human Touch

In the digital age, automation has become an integral part of lead generation insurance. It allows for efficient handling of leads, ensuring timely follow-ups and nurturing. However, it is important to strike the right balance between automation and the human touch.

While automated emails and chatbots can handle initial interactions and routine inquiries, it is crucial to provide opportunities for human interaction when needed. Personalized calls, face-to-face meetings, or webinars can help build stronger connections and address specific concerns that require a human touch.

4.4 Following Up And Nurturing Leads

The process of lead generation doesn’t end with capturing the contact information of potential customers. It is equally important to follow up and nurture these leads to convert them into loyal clients. Adopting a systematic lead nurturing approach can significantly boost your conversion rates.

Develop a lead nurturing strategy that includes regular follow-ups, providing relevant information, and educating prospects. Send personalized email campaigns, share informative content, and offer tailored solutions based on the specific needs and preferences of each lead.

5. Measurement And Evaluation Of Lead Generation In Insurance

Measuring and evaluating lead generation in insurance is crucial for understanding the effectiveness of marketing efforts and making informed business decisions. By analyzing key metrics and tracking ROI and conversion rates, insurance companies can optimize their lead generation strategies for better results.

5.1 Key Metrics For Assessing Lead Generation Performance

When it comes to assessing lead generation performance in the insurance industry, several key metrics play a vital role in measuring success. These metrics include conversion rates, cost per lead, lead-to-customer ratio, customer lifetime value, and return on investment.

5.2 Tracking Roi And Conversion Rates

Tracking ROI and conversion rates is essential for determining the profitability of lead generation campaigns. By analyzing the return on investment and conversion rates, insurance companies can gain valuable insights into the effectiveness of their marketing efforts and make data-driven decisions to optimize their lead generation strategies.

Credit: mediaboom.com

Frequently Asked Questions Of Lead Generation Insurance

What Is The Average Cost Per Lead Insurance?

The average cost per lead for insurance varies, but it is typically around $15 to $50. Factors such as lead quality and target market can impact the cost. It’s essential to analyze your specific requirements to get an accurate estimate.

Where Can I Find Leads For Insurance?

To find insurance leads, you can try various methods like networking with industry professionals, attending insurance conferences, using social media platforms, utilizing lead generation services, and building your own website with lead capture forms. These strategies can help you connect with potential customers who are interested in insurance products.

Is It Normal To Buy Leads In Insurance?

Yes, it is normal to buy leads in insurance.

What Is The Best Lead Generation Company?

The best lead generation company is one that understands your specific requirements and delivers high-quality leads consistently. Look for a company with a proven track record, experience in your industry, and a comprehensive lead generation strategy. Evaluate their success rate, customer reviews, and pricing to make an informed decision.

Conclusion

Lead generation insurance is an invaluable tool for businesses looking to expand their customer base and increase sales. With the right strategies in place, companies can effectively attract and convert potential leads into loyal customers. By leveraging various marketing techniques and analyzing data-driven insights, businesses can optimize their lead generation efforts and achieve long-term success.

Don’t miss the opportunity to take your business to the next level with lead generation insurance. Start implementing these strategies today and witness the growth firsthand.